Managing finances has always been a task I struggled to stay consistent with—until I came across the Finance Tracker by Path pages. After personally using it for a few weeks, I can confidently say that it’s one of the most effective tools I’ve tried for organizing and gaining control over my finances. It’s a relief to have found a solution that works. Here’s an honest breakdown of my experience.

Unique features of Finance Tracker by Path Pages

This template is a powerhouse of features, and I quickly saw how it could replace several other apps I used.

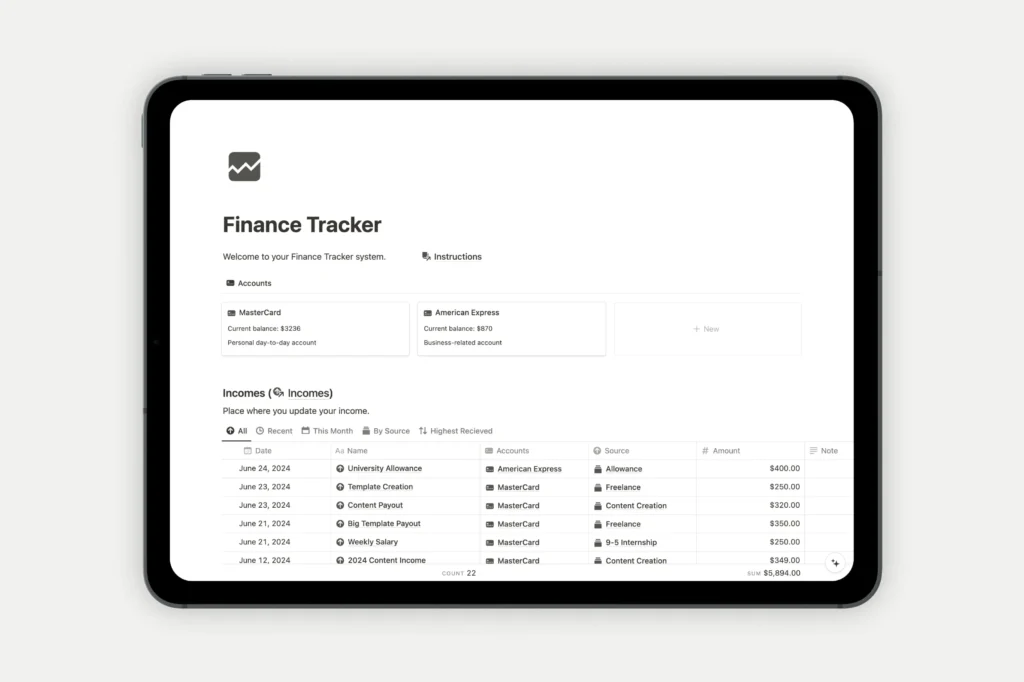

1. Dashboard

The dashboard became my go-to page, providing an overview of my monthly and yearly finances. It includes:

- Reports on income and expenses.

- Precise tracking of savings goals.

- A breakdown of spending categories.

It was so satisfying to see my progress at a glance.

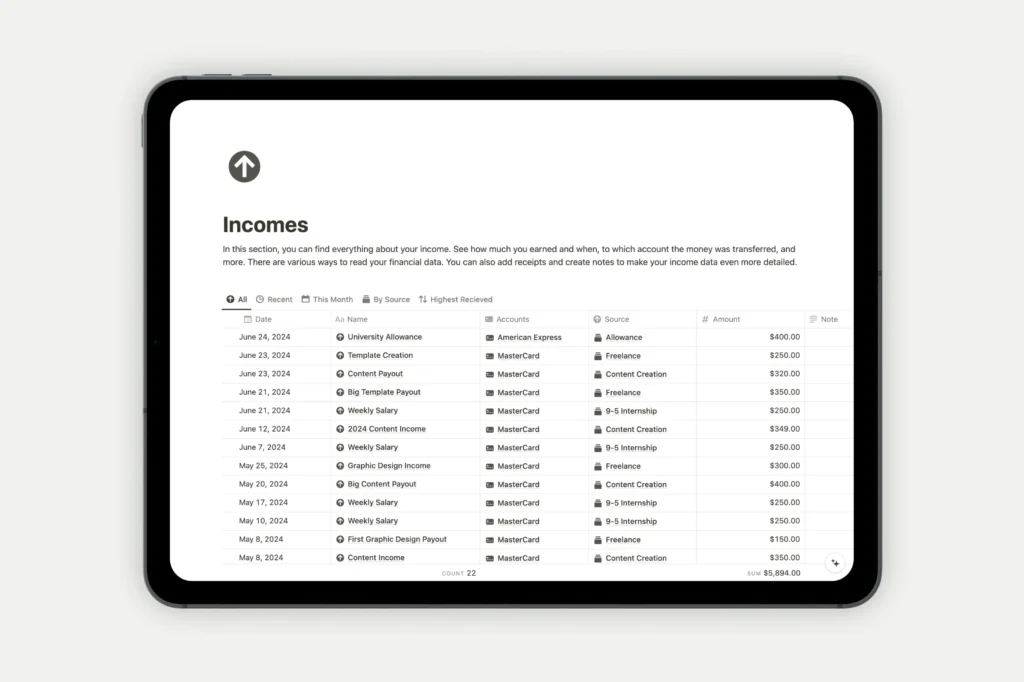

2. Income and Expenses Tracking

Manually inputting income and expenses might seem tedious, but how the template organizes this data made it enjoyable. I loved how I could sort transactions by month and category, giving me a clear picture of where my money was going.

3. Categories and Wallets

This feature stood out for its simplicity and practicality. I could easily categorize my spending (e.g., groceries, entertainment, bills) and manage balances across different wallets (bank accounts, cash, credit cards).

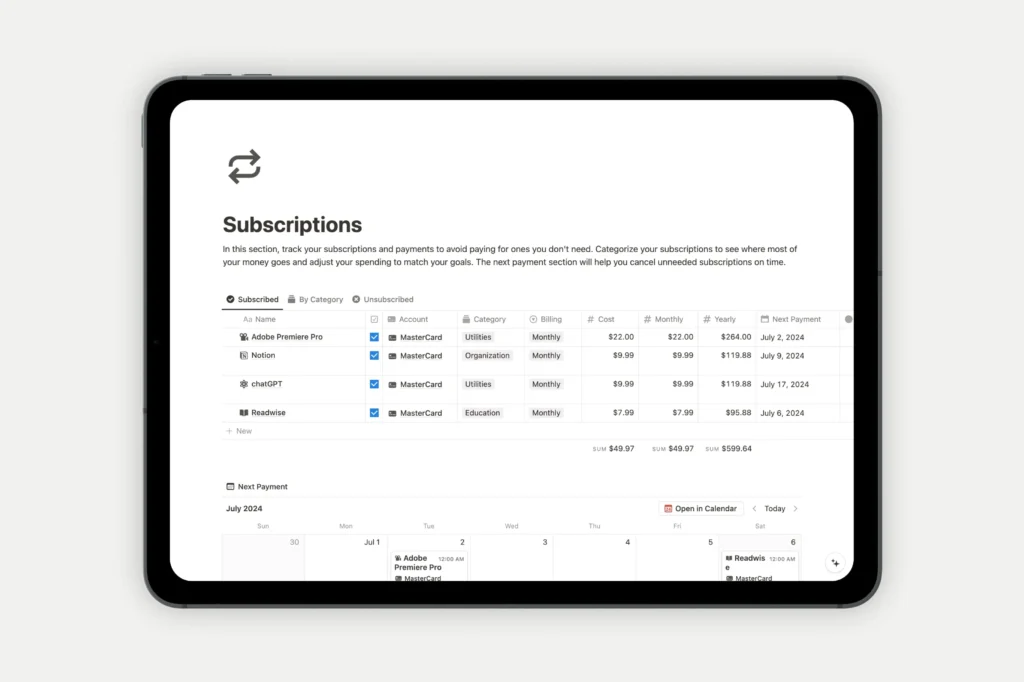

4. Subscription Tracker

This was a game-changer for me. I had just learned how many subscriptions I was paying for when I used this section. Tracking both active and canceled subscriptions helped me cut unnecessary costs.

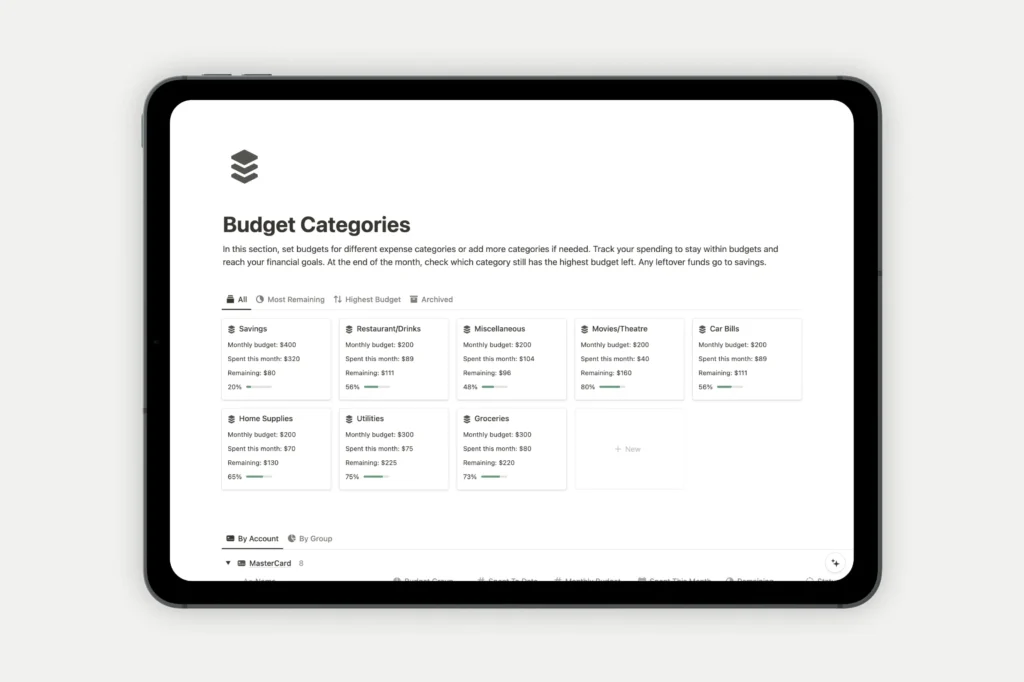

5. Budgeting Tool

The budgeting system follows the 50/30/20 rule, automatically showing how much I’ve spent and how much remains in each category. It was motivating to stay under budget and allocate more to savings.

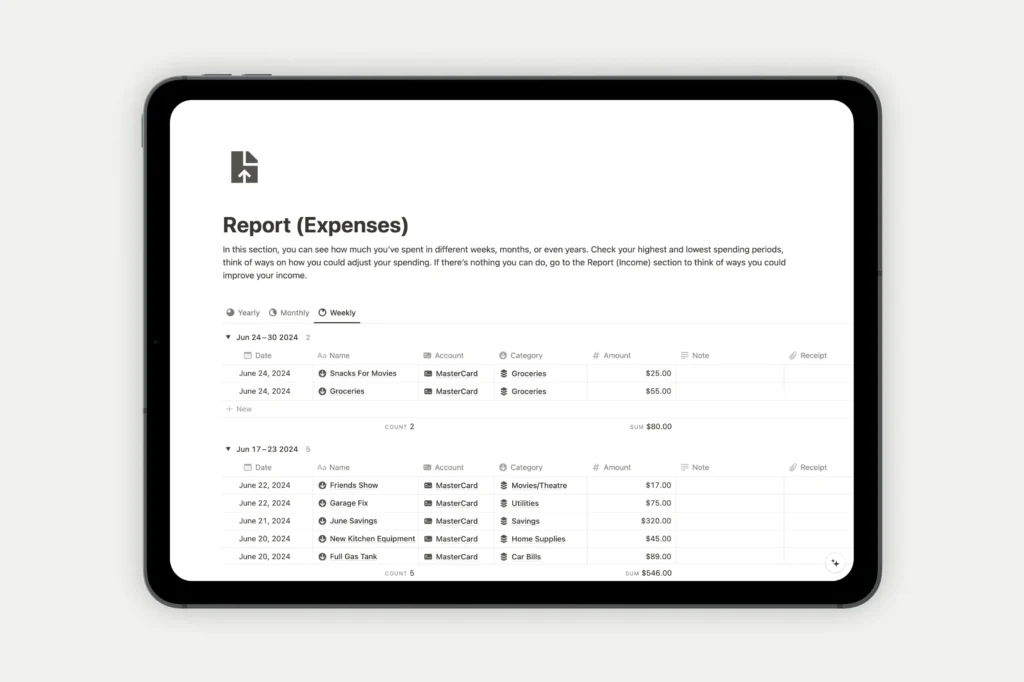

6. Automated Reports

The reports gave me insights I didn’t know I needed. Analyzing spending patterns over time helped me identify areas where I could cut back and save more.

Usability and Aesthetic Appeal

Ease of Use

The template strikes the perfect balance between simplicity and depth. As someone who’s relatively comfortable with Notion, I found the setup process straightforward. For beginners, the included prefilled examples make the transition seamless.

Video Tutorials

Although the video instructions are still “coming soon,” I didn’t feel lost at any point. The structure of the template is intuitive enough to navigate without extra guidance.

Design

I appreciated choosing between a minimalist black-and-white version or an aesthetic version with colors and gradients. I opted for the aesthetic version—it made tracking my finances more engaging.

Multi-Device Compatibility

Whether on my laptop or phone, the experience was consistent. This flexibility meant I could update my finances on the go, which was incredibly convenient. It’s a relief to know that I can manage my finances from anywhere, at any time.

Light and Dark Modes

As someone who switches between Notion’s light and dark modes depending on the time of day, I found it significant that the template was seamlessly adapted.

What I Loved Most

The Notion Finance Tracker transformed the way I manage my money. Here’s what stood out for me:

- Centralized Control: Everything—from income and expenses to subscriptions and savings goals—is in one place.

- Actionable Insights: The reports clarified my spending patterns and helped me make more informed decisions.

- Time-Saving: Setting it up was quick, and updating it daily takes just a few minutes, making it ideal for those with a busy schedule.

- Motivation to Save: Seeing my savings goals progress visually was a big motivator. It’s inspiring to see how far I’ve come and how much more I can achieve.

Challenges and Suggestions

No tool is perfect, and while I thoroughly enjoyed the template, here’s where I think it could improve:

- Video Tutorials: Although the template is intuitive, the promised tutorials would make the learning curve even more accessible for beginners.

- Automation: While manual tracking works well, adding automation (e.g., linking bank accounts) could save even more time.

Cost and Access: Is It Worth the Price?

I initially hesitated when I saw the price—$29 for the standalone Finance Tracker Template (discounted from $59) and $299 for the complete bundle. However, with the 50% discount code “BF2024,” the price felt much more reasonable.

The purchase process was straightforward. After buying the template, I received an email with a link to duplicate the template into my Notion workspace. I appreciated that it works seamlessly with a free Notion account—no extra tools or apps were needed.

The one-time payment also felt like fresh air compared to subscription-based finance tools I’ve tried.

Support: Always There When Needed

I didn’t run into any significant issues, but knowing that there’s an active community and email support at [email protected] was reassuring. The no-refund policy might be a downside for some, but I found the template’s quality more than justified the price.

Final Verdict: Should You Buy It?

After using the Notion Finance Tracker Template, I can confidently say it’s worth every penny—especially with the current discount. This template is a fantastic investment if you’re looking for a comprehensive, easy-to-use, and aesthetically pleasing way to manage your finances.

It’s helped me track my finances and build better financial habits, stay on top of my subscriptions, and plan for future goals.

So, if you’re tired of juggling multiple apps and spreadsheets, this template might just be the game-changer you need.

Ready to take control of your finances? Get the Notion Finance Tracker Template today and start your journey toward financial clarity.